It’s the time of year that most of us dread...tax season.

As the country embarks on paying the ‘taxman,’ you might as well equip yourself with everything you need to make the process a little less painful.

For those of you that fall under the employee category, filing taxes probably won’t be too difficult.

To help, we contacted Kelowna tax accountant Quinton Pullen.

Deadlines

Personal taxes are due April 30th and business taxes are due June 15th.

If you want to file late, or accidentally do, the Government will charge you a penalty based on the amount owing. The penalty is 5% of your 2016 balance owing, plus 1% of your balance owing for each full month your return is late, to a maximum of a year.

If you owe money and are late two years in a row, the penalties go way up.

Let’s just say, don’t be late unless the Government owes you money.

Tax brackets

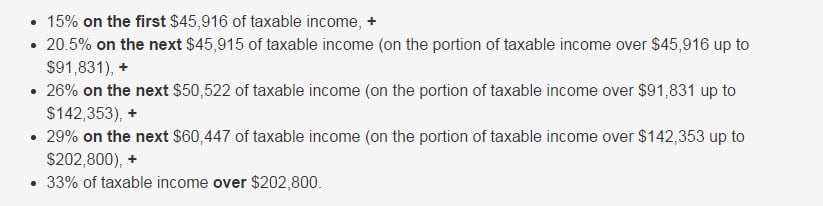

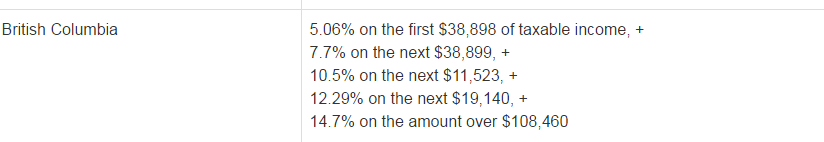

In Canada, taxes are calculated based on a graduated tax basis, meaning your income level decides how much you pay.

Federal tax rates for this year are as follows.

Provincial tax rates for B.C. are as follows.

What you need

Each person filing taxes should have a T1 form with information on income, credits and deductions.

If you are an employee, you will need a T4, stating how much your employer paid you. T4s were due from employers by the end of February, so you should have them by now.

If you had a return on investments, you will also need a T5.

You will need other forms if you were on EI, if you received worker’s compensation or if you were on social assistance.

How to file

There are a variety of ways to file your taxes so it’s best to decide with way is right for you.

If you are a T4 income earner, you can file your tax return online using an inexpensive program.

If you want to be doubly sure, you can go to an H&R Block, which is a little more expensive.

If you are a business owner, a property owner, or moved within the year, you will probably want to visit an accountant.

"Accounting firms are a great place to go to when you're more complex but for the simple returns, getting the software and just entering the numbers in is the easiest way to go,” said Pullen.

In the future, Pullen said the CRA will likely allow most people to file online with them through the push of a button, something they have said they are working on enabling.

"They'll still make you press the button. I don't see them changing that,” he explained.

What can you claim?

Take the time to figure out what expenses you can claim. Every little bit counts.

For example, if you moved this year, you can claim your moving expenses- like travel and meals. Even if you didn’t keep your receipts, there is a basic formula you can use.

This is something you may want to go over with an accountant, as 90-95% of them get questioned by the CRA, according to Pullen.

"You want to make sure that you've claimed everything that you can claim but you're also very clear that you're not claiming the wrong things because the CRA will question you to make sure you have all your ducks in a row, so to speak,” he explained.

If you have these types of claims that you haven't submitted, you have up to three years to submit.

This is the last year parents and guardians can claim children's art and fitness credits, as it's been cut by the Liberals. You can claim a maximum of $250 per child on arts and recreational activities and $500 on fitness.

In case you weren’t aware, you can also claim medical credits including prescriptions and dental bills. Go to your pharmacy and get a print out of all the prescriptions you got. The 12 months you claim is moveable so choose based on when you spent the most (ex. From October 2015-October 2016 instead of along the fiscal or calendar year.)

Parents, don’t forget to claim child care. This includes daycare, camps and boarding schools.

If your spouse or common-law partner made less than $11,500, you can claim their remaining personal exemption.

The two biggest tax shields left in Canada are the sale of your principal residence and the sale of shares from your business. In the case of the business, up to $824,000 will be shielded.

The change this year for home sales, is that you need to report the proceeds from home sales for tracking purposes, which was initiated in October.