Search KamloopsBCNow

- Food & Drink

- Biz+Tech

- Columns

- Travel & Lifestyle

- Arts & Culture

- News & City Info

- Events

- Webcams

- Advertise

- Real Estate

- Contests

- Best Of the city

- Faces of Kamloops

- More

- Real Estate Listings

- Subscribe

- Contact

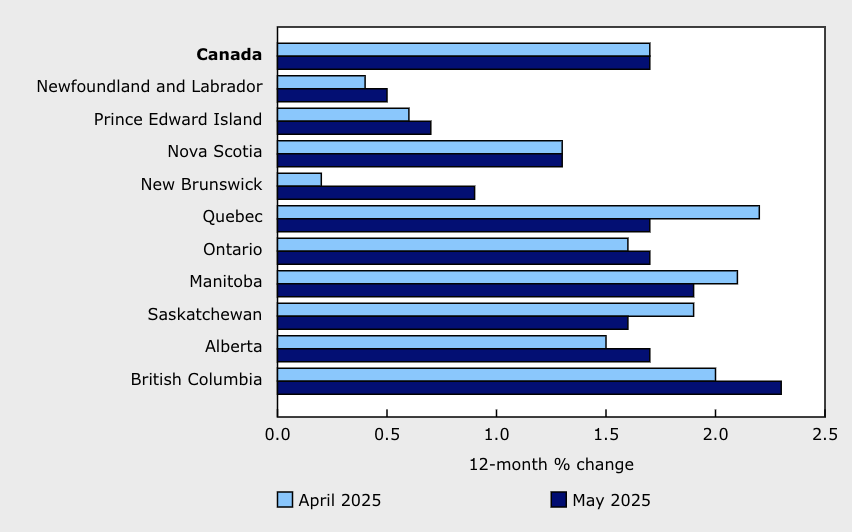

Canada’s inflation rate held steady in May at 1.7 per cent, according to Statistics Canada.

British Columbia’s rate, however, has grown to become the highest in the country at 2.3 per cent.

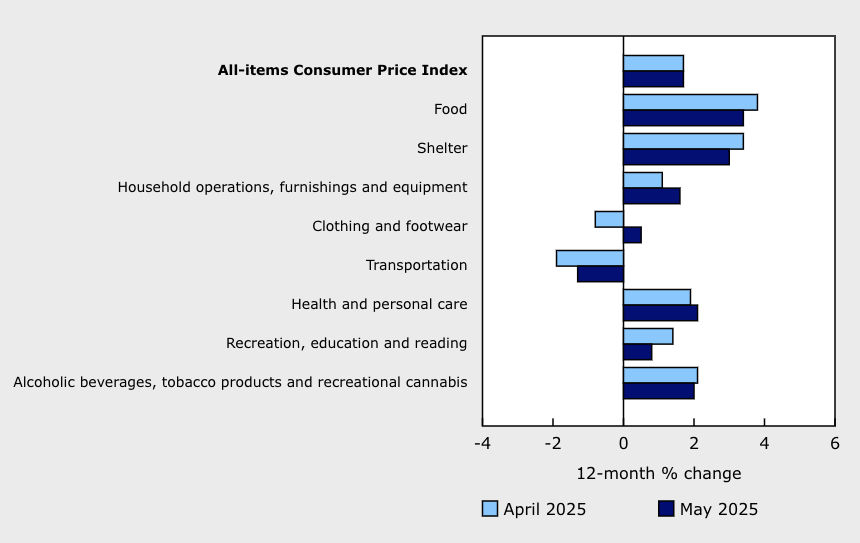

The agency said national rent and mortgage costs grew at a slower rate (three per cent) last month, providing relief as gas and cell services put “upward pressure” on inflation.

Excluding energy, StatCan said, inflation was 2.7 per cent in May, compared with 2.9 per cent in April.

Increased availability of rentals helped slow shelter costs in May, according to the agency, alongside slower population growth compared with last year.

For homeowners, meanwhile, the news was also positive, as mortgage interest costs slowed down for the 21st month in a row.

That’s come courtesy of lower Bank of Canada interest rates, with the key rate now at 2.75 per cent.

StatCan also highlighted the continuing benefits of Mark Carney’s decision to relent on the consumer carbon tax after years of Tory campaigning.

Gasoline was down 15.5 per cent on an annual basis in May, following an 18.1 per cent decline in April.

That was “primarily due to the removal” of the carbon tax, the agency explained.

Food prices, however, increased at a faster rate than overall prices in May, with groceries up 3.3 per cent compared with May 2024.

The Bank of Canada’s next rate announcement is set to come on July 30.